“Macroprudential policies are financial policies aimed at ensuring the stability of the financial system as a whole to prevent substantial disruptions in credit and other vital financial services necessary for stable economic growth. The stability of the financial system is at greater risk when financial vulnerabilities are high, such as when institutions and investors have high leverage and are overly reliant on uninsured short-term funding, and interconnections are complex and opaque. High vulnerabilities increase the likelihood that a firm’s failure or other negative shock would cause distress at other financial institutions because of direct exposures and through fire sales, contagion, or other negative externalities arising from the initial shock. Macroprudential policies aim to reduce the financial system’s sensitivity to shocks by limiting the buildup of financial vulnerabilities.”

– Kadija Yilla and Nellie Liang (Brookings, 2020)

Tightening likely in 2022

Macroprudential measures are likely to feature in this property market cycle, although the timing and extent of measures are unknown at this stage, according to Pete Wargent, co-founder of BuyersBuyers.com.au.

“Although there are a lot of variables, property investors should be aware that if activity accelerates sharply then the market regulator is quite likely to step in, and we recommend that investors prepare accordingly” Mr Wargent said.

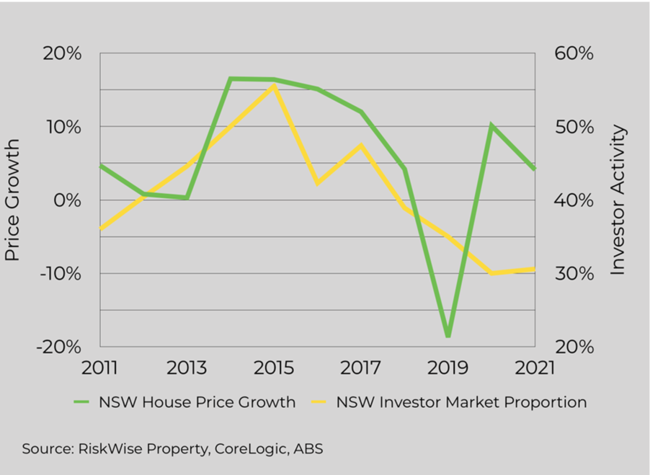

Doron Peleg, CEO of Riskwise Property agreed that macroprudential tightening was a likelihood during the current cycle, as low mortgage rates encourage a surge in property investment.

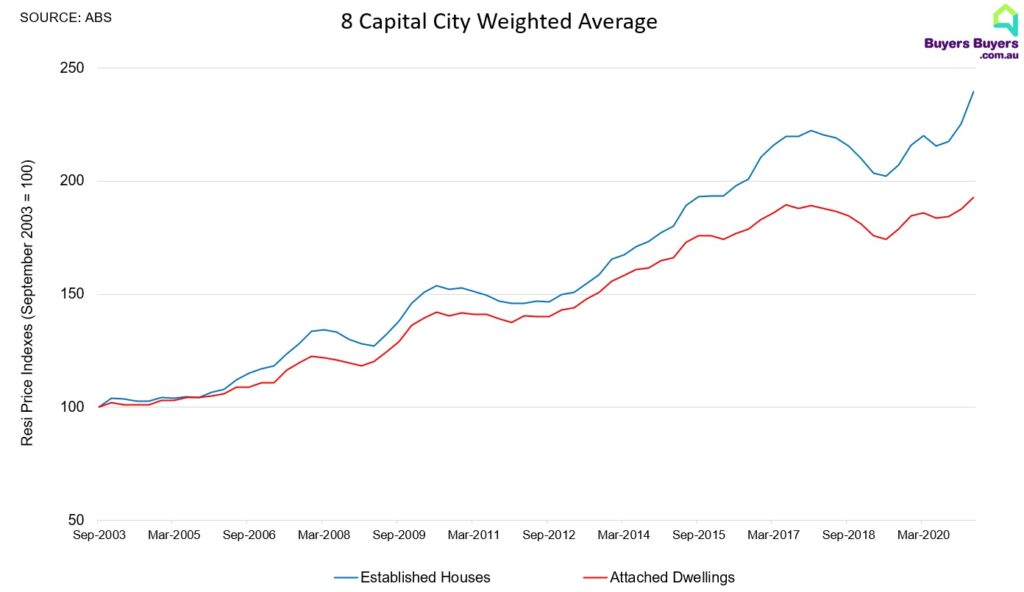

A graph of dwelling price indices shows the impact of the 2017 credit restrictions clearly.

“Based on our analysis and previous events (particularly the measures implemented in 2017), the likelihood that such measures will be implemented within the next 12 months is relatively high” Mr Peleg said. However, Peleg pointed out that at this point of time there are only indications regarding the nature of these measures being a combination of:

- changes to the ‘floor assessment’ rate at the individual loan level;

- LVR restrictions or caps at the portfolio level

- potential debt-to-income (DTI) ratio restrictions at the portfolio level.

In addition, there are no indications regarding the implementation date.

“Since recent cycles have suggested that property investor activity tends to amplify the property market cycles, it is likely that credit restrictions would significantly stymy growth, if not cause the market to stall or decline moderately” Mr Peleg said.

Figure 2 – Dwelling prices indices, Australia

Tips for property investors

Pete Wargent of BuyersBuyers.com.au said investors need to be aware of the potential for changes to lending standards and should therefore factor in the below points.

Investors need to:

If they are determined to buy, don’t wait until credit restrictions are implemented, as it will be substantially harder to get a loan

- Ensure that you have sufficient funds to cover unexpected events, including an increase in interest rates

- Focus on family-suitable properties, preferably freestanding houses in areas with good access to the major employment hubs in New South Wales, Victoria, and south-east Queensland

- Look for a ‘A-Grade’ property, i.e. properties that ‘tick all the boxes’ and do not have any major issues in relation to property location (e.g. main roads), attributes (e.g. small houses), etc.

- Family-suitable ‘A-Grade’ properties enjoy better demand than other properties even when the market is weaker

Mr Wargent said, “we know from recent history that the regulators won’t want investor lending to run too hot, so it makes sense for investors to prepare accordinghttps://www.facebook.com/148640260308695/videos/167180658733868ly rather than be surprised by restrictions as and when they do happen”.